mississippi state income tax rate 2021

80-107 IncomeWithholding Tax Schedule. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax rate of 0 on the first 5000 of taxable income.

. Other things to know about Mississippi state taxes The state also collects taxes on cigarettes and. Corporate Income and Franchise Tax Forms. 5 on all taxable income over 10000.

3 on the next 3000 of taxable income. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

Mississippi Income Tax Calculator 2021. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Mississippi has a graduated income tax rate and is computed as follows.

80-155 Net Operating Loss Schedule. Discover Helpful Information And Resources On Taxes From AARP. As fiscal year 2023 begins the 4 tax on an individuals first 4000 of taxable income will be eliminated entirely.

Corporate and Partnership Income Tax Help. The proposed legislation does so by gradually increasing the personal exemption until the income tax is ultimately eliminated. Any income over 10000 would be taxes at the highest rate of 5.

Detailed Mississippi state income tax rates and brackets are available on this page. Beginning in 2022 the personal exemption would dramatically increase to 47700 for individuals 95400 for. Detailed Mississippi state income tax rates and brackets are available on this page.

Income Tax Rates Taxable Income Tax Rate First 4000 0 Next 1000 3 Next 5000 4 Excess of 10000 5 If you have any questions contact Withholding Tax at the address below. Gains - Dealings in Property. Pass Through Entity Forms Mailing Address Information Combined Filers - Filing and Payment Procedures Hurricane Katrina Information Eligible Charitable Organizations Information.

Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Ad Compare Your 2022 Tax Bracket vs.

Your 2021 Tax Bracket To See Whats Been Adjusted. Voluntary Disclosure Agreement Program First-time Home Buyer Savings Account Deduction Charitable Contribution Tax Credit and Foster Care Charitable Tax Credits E. 4 on the next 5000 of taxable income.

80-100 Individual Income Tax Instructions. The Mississippi Tax Freedom Act aims to eliminate the individual income tax in a period as short as a decade. Tax Rates Exemptions Deductions.

Withholding Tax Income Franchise Tax Bureau Post Office Box 1033 Jackson MS 39215-1033 601-923-7700. For single taxpayers living and working in the state of Mississippi. Ad Compare Your 2022 Tax Bracket vs.

Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. 80-105 Resident Return. Income ranging between 5000 to 10000 would be taxed at 5.

Mississippi Income Taxes. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. For tax year 2021 the first 4000 of earned income would not be taxed and the next 1000 is taxable at a rate of 3.

3 on the next 2000 of taxable income. Check the 2021 Mississippi state tax rate and the rules to calculate state income tax. For married taxpayers living and working in the state of Mississippi.

These rates are the same for individuals and businesses. Your average tax rate is. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

80-115 Declaration for E-File. Income Tax Rates Taxable Income Tax Rate First 4000 0 Next 1000 3 Next 5000 4 Excess of 10000 5 If you have any questions contact Withholding Tax at the address below. Tax rate of 0 on the first 5000 of taxable income.

Detailed Mississippi state. 5 on all taxable income over 10000. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

How do I compute the income tax due. Taxable and Deductible Items. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Mississippi Tax Brackets for Tax Year 2021. Any income over 10000 would be taxes at the highest rate of 5. Calculate your state income tax step by step.

For 2022 the first 5000 of income tax is not taxed. Find your gross income. Find your pretax deductions including 401K flexible account contributions.

80-106 IndividualFiduciary Income Tax Voucher. The graduated income tax rate is. Corporate Income Tax Division.

71-661 Installment Agreement. Ad See If You Qualify To File For Free With TurboTax Free Edition. Mississippis Individual Income Tax Rate Schedule Tax Year 2021 All Filers 3 4000 4 5000.

Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. Withholding Exemption Certificate Completed by employee. There is no tax schedule for Mississippi income taxes.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Does Mississippi have a minimum corporate income tax. 80-108 Itemized Deductions Schedule.

Tax Year 2018 First 1000 0 and the next 4000 3 Tax Year 2019 First 2000 0 and the next 3000 3 Tax Year 2020 First 3000 0 and the next 2000 3 Tax Year 2021 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0. The graduated income tax rate is. Tax rate of 5 on taxable income over 10000.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross. Mississippi State Taxes 2021.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. 0 on the first 3000 of taxable income. Tax rate of 4 on taxable income between 5001 and 10000.

The tax brackets are the same for all filing statuses. 4 on the next 5000 of taxable income. The largest increase in poverty rate by state is Alaska where the 2014 share of the population below the poverty line stood at 101 before rising 06 to its current level of 107.

0 on the first 2000 of taxable income.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Mississippi Tax Rate H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

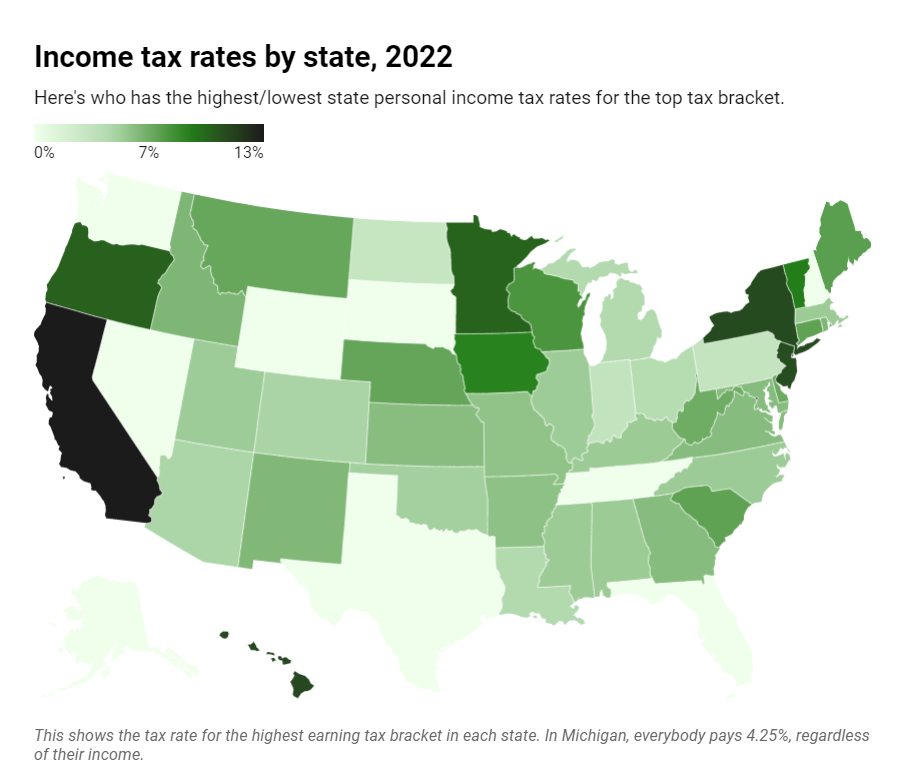

Lowest Highest Taxed States H R Block Blog

State Income Tax Rates Highest Lowest 2021 Changes

Excel Formula Income Tax Bracket Calculation Exceljet

Should You Move To A State With No Income Tax Forbes Advisor

How To Calculate Income Tax In Excel

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Income Tax H R Block

State Income Tax Rates What They Are How They Work Nerdwallet

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

How Much Will I Pay In Income Tax While Working On An H1b In The Us

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube